Unlock Your Home's Potential With Michael Friedman

Discover the power of Reverse mortgages, Reverse purchase mortgages, and Reverse Jumbo Mortgages. Trust Michael Friedman for expert Guidance and support.

Reverse Mortgages

Meet Michael Friedman: Your Trusted Home Financial Advisor

Michael Friedman, we pride ourselves on being more than just a financial services provider – we’re your dedicated partners in navigating the complex world of Reverse Mortgage. With years of experience and a commitment to integrity, we’ve built a reputation for delivering tailored solutions that empower homeowners to make informed decisions about their financial future. Our mission is simple: to help you unlock the full potential of your home’s value while providing the guidance and support you need every step of the way.

Low Rates and No Monthly Mortgage Payments. Monthly payment or optional

Reverse Purchase

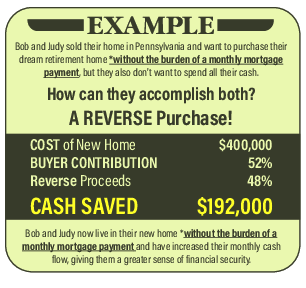

A Reverse purchase mortgage can help buyers purchase the right home / Condo without the burden of a monthly mortgage payment, Under most circumstances, a borrower can expect to put down about half the amount of the sales price and the Reverse mortgage will cover the rest.

Reverse Mortgage

A financial planning tool / safety net for so many older adults. Today many people are living longer and running low on money. Make sure your spouse/ partner is financially secure.

Providing the Best Future for Your Best Living

At our core, we’re dedicated to shaping the ideal tomorrow for each of our clients, ensuring that every aspect of their lives is optimized for maximum fulfillment and prosperity. By meticulously crafting personalized plans tailored to individual aspirations and circumstances, we strive to enhance the present while safeguarding your future endeavors.

Empowering Your Home Financial Journey with Michael Friedman

Explore a comprehensive range of expert services tailored to your home financial needs. From maximizing home equity and securing loans to navigating Reverse mortgages, Michael Friedman is your trusted partner in achieving your financial goals with confidence and clarity.

A future where their best living becomes not just a dream anymore.

Unlocking Your Home's Potential: Our Comprehensive Offerings

Discover a suite of tailored financial solutions designed to optimize your home’s value and empower your financial future. Michael Friedman offers expertise and support to help you make informed decisions and achieve your homeownership goals with confidence.

Reverse Mortgage

Unlock the hidden value of your home with our expertly crafted Reverse mortgage solutions. Whether you're looking to supplement your retirement income or achieve greater financial flexibility, Michael Friedman provides personalized guidance to help you navigate this innovative financial tool with confidence and security.

Reverse Purchase

Unlock the potential of Reverse purchase options with Michael Friedman. Whether you're looking to downsize, relocate, or transition to a new home, our expert guidance and personalized solutions can help you make the most of your home equity. Explore the benefits of Reverse purchase financing and embark on your next chapter with confidence.

Reverse Jumbo Purchase

Navigate the complexities of high-value home purchases with ease with Michael Friedman's Reverse Jumbo Purchase services. Designed for homeowners seeking to purchase luxury properties or high-value estates, our specialized solutions offer flexibility, security, and peace of mind. Trust our team to tailor a Reverse jumbo purchase plan that meets your unique needs and aspirations. Jumbo loan amounts up to $4 million

Your Home, Your Future, Our Commitment

Michael Friedman specializes in Reverse Mortgage, Reverse Purchase and Reverse Jumbo Mortgages. Selecting the right partner for your home financial needs are crucial. Here are three compelling reasons why homeowners choose us:

Expertise and Experience:

With years of experience in the industry, Michael Friedman brings unparalleled expertise to the table.

Personalized Approach

We believe that every homeowner deserves a customized approach to their financial journey.

Commitment to Client Success

Michael Friedman, our clients' success is our top priority. We go above and beyond to ensure that you feel supported and empowered throughout the entire process.

Reverse Mortgage Suitability Test

- How likely are you to need more money or savings in retirement, either now or sometime in the future?

- Is it important to you to remain financially independent and not rely on others for support?

- How long do you plan to live in your current home?

- Would you be willing to use some of your home equity to improve your quality of life?

- Is it more important for you to leave as much as possible for your heirs or have more money to use now?

"Reverse Mortgages Make a Difference in People's Lives"

Tips for Older Homeowners

Don't Wait Until the Last Minute:

Timing is critical when making decisions about the home. You or your family could end up facing a serious crunch if you wait until a crisis to start thinking about how to use home equity. To avoid stress, disappointment, and costly delays, plan in advance. The longer you wait, the harder it can be to find a good situation.

Have Ready Cash for Emergencies:

It helps to have a three-month emergency fund of cash you can access easily, such as a money market account or short-term certificate of deposit. If this is not possible, make plans and prepare for how you would pay for an emergency. If you run short, use credit cards sensibly. Beware of anyone who offers a quick fix to your financial problems.

Let’s talk with a specialist

Unlock the insights you need with a personalized consultation from our expert specialists. Here’s why you should schedule a discussion today:

- Expert Insights:

Gain valuable insights and expert analysis from our seasoned specialists who have in-depth knowledge of the real estate market and mortgage industry.

- Transparent Communication

Experience transparent and open communication throughout the consultation process, ensuring that you feel informed and empowered to make confident decisions about your home financial journey.

Make an Appointment

Take the first step towards achieving your homeownership goals by scheduling a personalized appointment with our Michael Friedman.

What our clients say about us

Discover firsthand testimonials from our satisfied clients who have experienced the exceptional service and expertise provided by Michael Friedman. Their feedback reflects our commitment to delivering personalized solutions and exceeding expectations in every aspect of the home financial journey.

"Working with Michael Friedman was an absolute pleasure. From the moment I reached out, I felt supported and understood. Michael's personalized approach and attention to detail made the entire process of securing a home loan smooth and stress-free. I couldn't be happier with the outcome!"

I had the pleasure of partnering with Michael Friedman for a Reverse mortgage, and I couldn't be more impressed with the level of professionalism and expertise. Michael took the time to explain all my options thoroughly and helped me make informed decisions about my financial future.

Michael Friedman provided exceptional service throughout the entire process of refinancing my mortgage. His knowledge and expertise were evident from our first consultation, and he went above and beyond to ensure that I received the best possible terms. I truly appreciate Michael's dedication and would confidently recommend his services.

Pennsylvania Department of Banking and Securities- License # 53672 – Company NMLS# 1396947 – PA mortgage originator license #131880

“This material is not from HUD or FHA and has not been approved by HUD or a government agency.”

Privacy Policy:

We are the sole owners of the information collected on this website. We only have access to collect information that you voluntarily give us via email or other direct contacts from you. We will not sell or rent this information to anyone. We will use your information to respond to you, regarding the reason you contacted us. We will not share your information with any third party outside of our company, other than necessary to fulfill your request. Unless you ask us not to, we may contact you via in the future to tell you about specials, new products or services, or changes to this privacy policy. You may opt-out of any future contacts from us at any time. You can do the following at any time by contacting us via the email address, or phone number given on our website.

Security:

We take precautions to protect your information. When you submit sensitive information via the website, your information is protected both online and offline. We do not collect any credit information at all.

Privacy Questions:

If you have any questions or concerns about Reversing PA Mortgage, LLC. privacy policy, please contact us at ( info@reversingmtg.com )